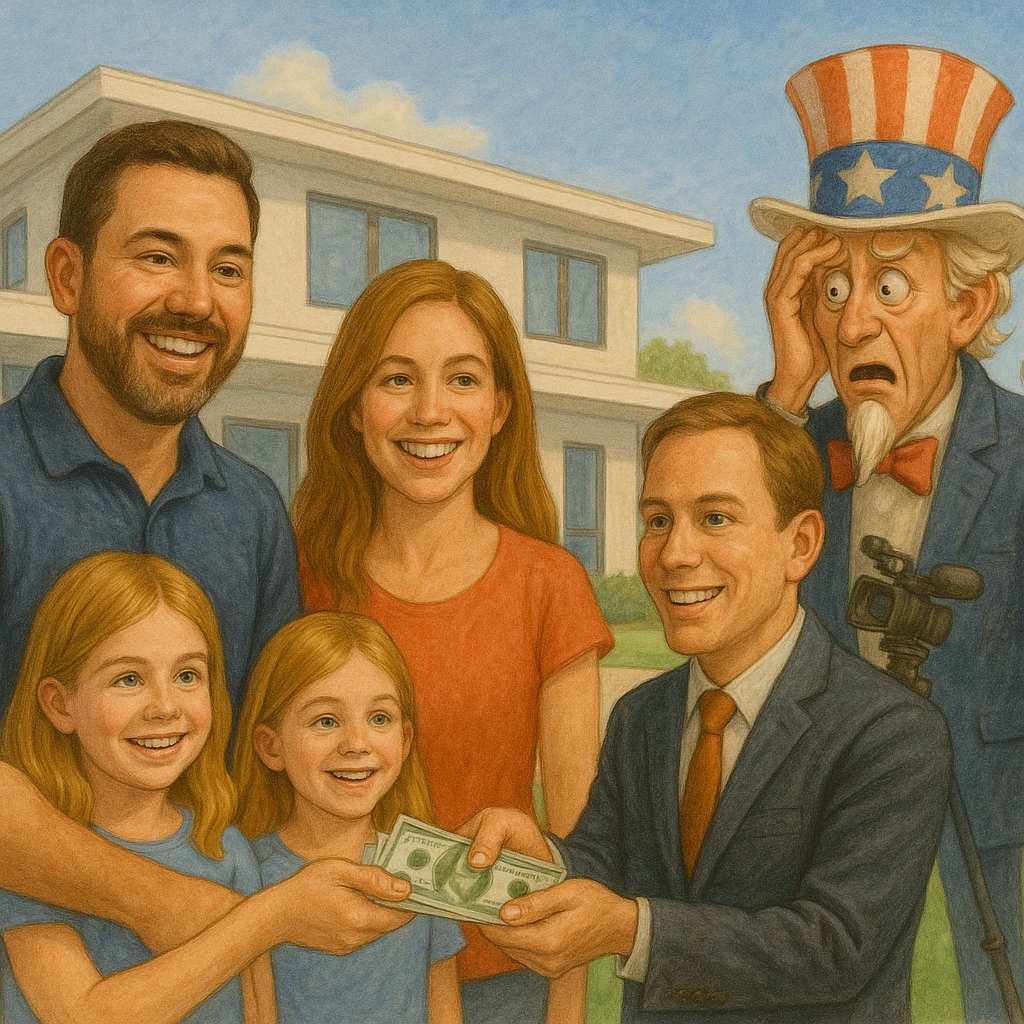

How Trump’s New Tax Cuts + Lower Interest Rates Could Supercharge the Housing Market

There’s a wave of optimism building across the real estate world—especially after the passing of Trump’s One Big Beautiful Bill and his strong stance urging the Fed to lower interest rates. For homebuyers, investors, and industry pros, this one-two punch of policy could be a game-changer.

Let’s break down how this powerful economic combo could supercharge the housing market and real estate investment opportunities—especially in hot zones like South Florida.

🔑 1. More Money in Buyers’ Pockets = More Demand

Trump’s new tax bill extends and expands the 2017 tax cuts for middle-class Americans. That means:

-

Lower effective tax rates = higher take-home pay

-

Families earning $30K–$80K could see an average $10,000 boost in annual disposable income

-

Enhanced Child Tax Credit and deductions for tips/overtime increase cash flow for hourly workers

What this means for real estate:

More buyers will now qualify for mortgages. With more cash and confidence, families previously priced out of the market can now seriously consider homeownership—fueling demand across entry-level and mid-tier markets.

🏠 2. Lower Interest Rates = Cheaper Mortgages

If Trump successfully pressures the Fed to lower interest rates, it could bring mortgage rates closer to the 3–4% range again (down from recent highs above 7%).

What this means for real estate:

-

A $500K mortgage at 7% vs. 4% saves buyers over $800/month

-

Lower monthly payments = more purchasing power

-

Investors can leverage cheaper financing for flips and rental properties

-

Cap rates on rental properties improve as borrowing costs drop

This could create a surge in buying activity, especially in fast-growing markets like Boca Raton, Miami, and other Sunbelt metros.

💼 3. Boost for Real Estate Investors & Small Business Owners

The bill includes provisions to make Trump-era pass-through deductions permanent, which means:

-

Real estate professionals, LLC investors, and S-Corp owners can continue to deduct 20% of qualified income

-

Depreciation benefits stay intact (100% DEPRECIATION IS BACK!!)

-

More favorable tax treatment on investment property income

What this means for investors:

Returns just got better. Lower taxes on rental income, capital gains, and flip profits increase the upside—making real estate one of the most attractive investment vehicles again.

🚘 4. Tax Breaks on Auto Loans = Indirect Housing Boost

Buyers with lower auto payments (thanks to the auto loan interest deduction) will improve their debt-to-income ratios, helping them qualify for home loans they might have missed out on before.

👵 5. Senior & Retiree-Friendly Deductions

The expanded senior deduction (up to $6K) offers additional financial breathing room for retirees living on fixed incomes.

What this means for the market:

More active downsizing, relocating, or purchasing retirement homes in states like Florida and Texas—markets with no state income tax and favorable climates.

🧠 Final Thought: The Perfect Storm for a Real Estate Boom?

When you mix lower taxes, cheaper borrowing, and rising consumer confidence, you get one thing: momentum.

We’re heading into a market environment that could rival the early 2010s real estate boom—with investors returning, buyers re-entering, and developers restarting projects that had been paused.

If you’ve been waiting to invest, upsize, or relocate—this is the window you’ve been waiting for.

Ready to take advantage of this new market wave?

The Melerine Group is here to help you navigate the opportunities, whether you're buying your dream home or building your real estate portfolio.

📲 Let’s talk strategy: 786-554-6435

🌐 www.MelerineGroup.com

Categories

Recent Posts